Fintech Under The Hood: Financial/Fintech Infra & APIs

End of the year update about what I care the most in Fintech

In 2015, I visited the offices of Marqeta along with my co-founder and met Jason Gardner in a small office in Oakland, California. During the discussion he dropped a bolt from the blue that they were going to help customers issue cards via APIs — it was totally mind-blowing for me and I will be honest I couldn't fully grasp the concept of what will become a huge thing in the fintech world. In the past, the sole avenue for offering financial products like cards, bank accounts, or loans to customers involved investing years and millions of dollars in attempting to become a bank and not to mention collaboration with legacy processors. Launching a product with these providers could consume a year or more, demand a huge investment and entail substantial engineering effort. So you can understand my excitement after meeting Jason.

Fast forward a few years, and there I was in my Bangalore office, engaged in a deep whiteboarding session with an extraordinary founder and friend, Madhusudan from M2P. and around the same time that year I was actively discussing eKYC stuff with the dynamic duo (and dear friends) - Ankit and Arpit from Signzy. I was beginning to understand the power of FinTech under the hood especially in the Indian context. The rails and infra that will power consumer fintech and banks/neobanks and more.

By 2018 things became very clear to me that financial/fintech infra and APIs is the (cliched) Next Big Thing. The e-plumbing and financial rewiring that has been rewriting how financial services are delivered and experienced – its time had come. I invested in a bunch of companies in the coming years and started a podcast (MEDICI) focused on the part of FinTech innovation that is invisible to the end-customers. Had a lot of discussions with Fintech, banking and tech folks about how financial firms (old and new) are leveraging the power of open banking and APIs. And thoroughly loved creating those episodes.

Up until 2019 I think, most of all media hype was about consumer fintech/neobanks (Paytm, PhonePe, et al) and it still is today to a large extent while so much happens in the financial/fintech infra and APIs as well. So I thought it's essential to delve deeper into the mechanics of this sector and explain what happens "under the hood." These companies actually offer APIs (Application Programming Interfaces) and SDKs (Software Development Kits) for easy integration of their services into the banks’ and tech firms' existing systems. All the consumer FinTech products that you love are supported and powered by a massive under-the-hood fin and tech infrastructure.

Over the years this infrastructure has become an interesting offering in the market in the form of ‘APIs’ by some companies (mostly startups) where the focus is on the developer (as a customer). Some of these developer platforms will become massive businesses in the future. And my bet is that we will see atleast 7-10 more billion dollar businesses from India serving Global in the next 5 years in this "segment" of #Fintech

I think a lot has been said in the recent years about US and European Financial Infra & Fintech APIs models and players. To shed more light on India, we have compiled a comprehensive list of companies providing Financial Infrastructure and Fintech APIs in India powering financial services and consumer fintech. I have tracked these B2B (sometimes B2B2C) companies over the years for various purposes starting from MEDICI platform to making equity investments.

Every component of the financial stack is becoming an API. It took some time (have been saying this since 2016) but it's happening rapidly now. From payments, card issuing to virtual accounts, practically every back-end functionality that enables banking/finserv products is being made available to ‘developers’ as APIs. And it's not just about financial services; it’s happening everywhere. Companies like AWS changed the on-prem model and brought cloud infrastructure for renting computing and storage. Twilio changed that for communications, Google for maps, and Stripe is doing that for financial infrastructure. These and other API companies have started a supply chain revolution in software (in matured automotive supply chains 70% of the vehicle parts/modules come from suppliers).

Another significant aspect is the increasing number of publicly listed companies in India in this fintech domain. Protean's IPO in November is noteworthy. Other listed players are Nucleus Software, Infibeam Avenues, Veefin, Niyogin, NIST, Cams, Kfintech and Apollo Finvest amongst others. This is an indication of maturity and progress. Also Perfios, a leading B2B SaaS fintech company in India, secured a $229 million investment from Kedaara Capital in a Series D funding round. This investment, one of the largest in the Indian B2B SaaS space for the year. Signs of things to come :)

This entire ecosystem of Fintech under the hood can be divided into various distinct segments, each playing a crucial role in powering the sector's growth:

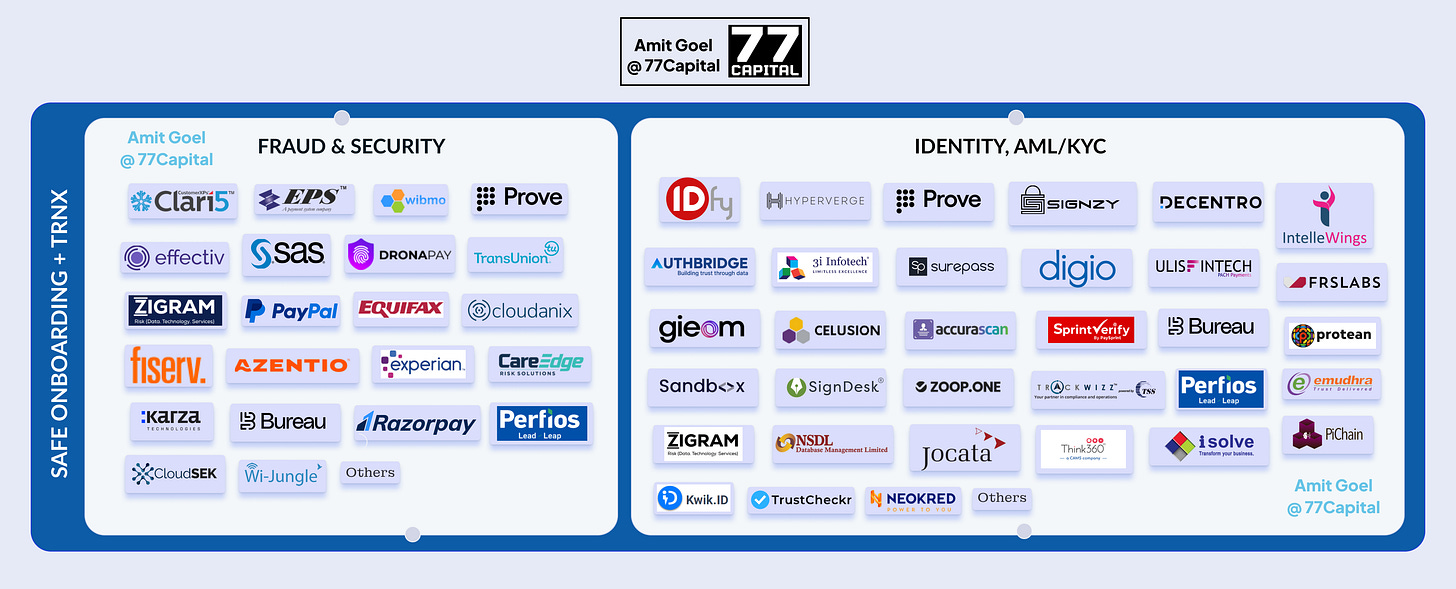

Safe Onboarding and Safe Transactions:

Identity, KYC and AML:

These are the companies providing means (and tech) to verify the identity of customers and assess their financial risk profiles. In essence, Identity, KYC, and AML tech companies provide the technological backbone that enables banks and fintech firms to onboard customers quickly and securely, while ensuring compliance with regulatory requirements and safeguarding against financial crimes.

It's a crowded space today but some of the pioneering companies in this space like Signzy, Hyperverge and Idfy have grown and some have revenues reaching $20 m and are expanding into foreign markets. Some even saw M&A such as Karza (Perfios).

Fraud & Security:

As the fintech landscape evolves, so do the threats. Innovative companies in India are developing state-of-the-art fraud detection and security solutions and APIs to safeguard user data and financial transactions. The fraud is rampant in India. Very few people talk about it. There are all kinds of frauds from account takeovers to UPI related fraud. Infographics highlights scarcity of solutions in fraud and security, underscoring the need for more top-tier companies in this sector. This is an area as an investor I am very interested in (also because of my role in Prove India earlier)

Application Infra:

Lending - Infra, APIs, Analytics & Data:

These are the companies offering solutions in the lending landscape simplifying credit/loan processes by offering APIs, LOS/LMS or other softwares and infra to lenders.

They consist of Embedded lending, Income verification, Origination and Servicing to help automate the entire lending lifecycle. A great example of a company in this space is Perfios which is a provider of comprehensive financial data and analytics solutions to banks, financial institutions, and corporations. The company's platform provides access to a wide range of data, including credit bureau data, transaction data, and market data. Perfios's data and analytics solutions are used by its clients to make informed decisions about credit risk, fraud prevention, and customer acquisition.

Payments - Infra, APIs, etc.:

Fintech is enhancing payments, enabling faster, cheaper, and more convenient ways to send and receive money. PG/PAs and processors are enabling businesses to accept online and offline payments. Furthermore, there are Card Issuance and Acceptance, Cross-border payment solutions, and Local payments infra in P2P and B2B segments. A great example of such a company is M2P

Core & Application Infra

Open Banking/Account Aggregation/Data

APIs and infrastructure that enable fintech companies and others to access financial data from FIPs (financial information providers) and share data securely to FIUs (users). In the Indian we have Account Aggregator (AA) Framework that brought data accessibility that improved access to financial data for lenders and fintech firms, enabling more accurate credit assessments and tailored financial products.

BankTech & BaaS

Core Banking - The backbone of any financial institution, core banking infrastructure is essential for processing and managing customer accounts, transactions, and more. and ofcourse the Middleware solutions that connect different systems and applications.

In this category I have also included Licensed Banks that offer regulated financial services.

Capital Markets, Investments & Wealth:

This segment encompasses companies providing infrastructure for Trading platforms, Credit, and Deposits along with Alternative investments

Insurance:

The insurance platforms address the core operations of insurance companies, including policy management, claims processing, underwriting, and distribution. As an example, Riskcovry worked hard with Insurance companies and brought 100s of insurance products on a single distribution API. this allows anyone to sell insurance and create affordable sachet insurance.

While India's fintech ecosystem has made significant strides, there remains ample room for improvement. In the capital markets segment, there's a clear need for more fintech API and infrastructure providers to enhance trading, investment, and lending experiences. And the areas of fraud and security present opportunities for new players to enter the market and provide innovative solutions as fraud becomes sophisticated and scales.

Also, I think none of the above could have been possible without the influence and basic building blocks provided by India Stack and Digital Public Infrastructure. It takes a village as they say. Example is that of Aadhaar's Influence:

KYC Efficiency: Revolutionized KYC processes, reducing the time and cost involved in customer onboarding significantly.

Financial Inclusion: Enabled access to banking and financial services for a larger segment of the population, especially in rural and semi-urban areas.

In conclusion, India's fintech sector continues to evolve and thrive, offering immense potential for growth and innovation. As the industry matures, the role of API and infrastructure providers becomes increasingly crucial, enabling fintech companies to deliver cutting-edge solutions and services to their customers. With the right players and innovations in this space, the future of fintech in India holds great promise.

Note:

If you are a founder building in this space please reach out!

While I've put in considerable effort to include companies within my knowledge, it's possible that I might have overlooked a few. My aim was to maintain broader definitions, with a particular emphasis on tech-first and tech-enabled companies. Although traditional firms undeniably contribute value to the ecosystem, my primary focus wasn't centered around them. They certainly have a definitive place in the tech ecosystem, but my main emphasis in this article was on the tech-oriented entities.

If you believe I may have overlooked your company or any other that deserves coverage, please reach out to me at amit@77.capital